2024 Joint Filing Tax Brackets

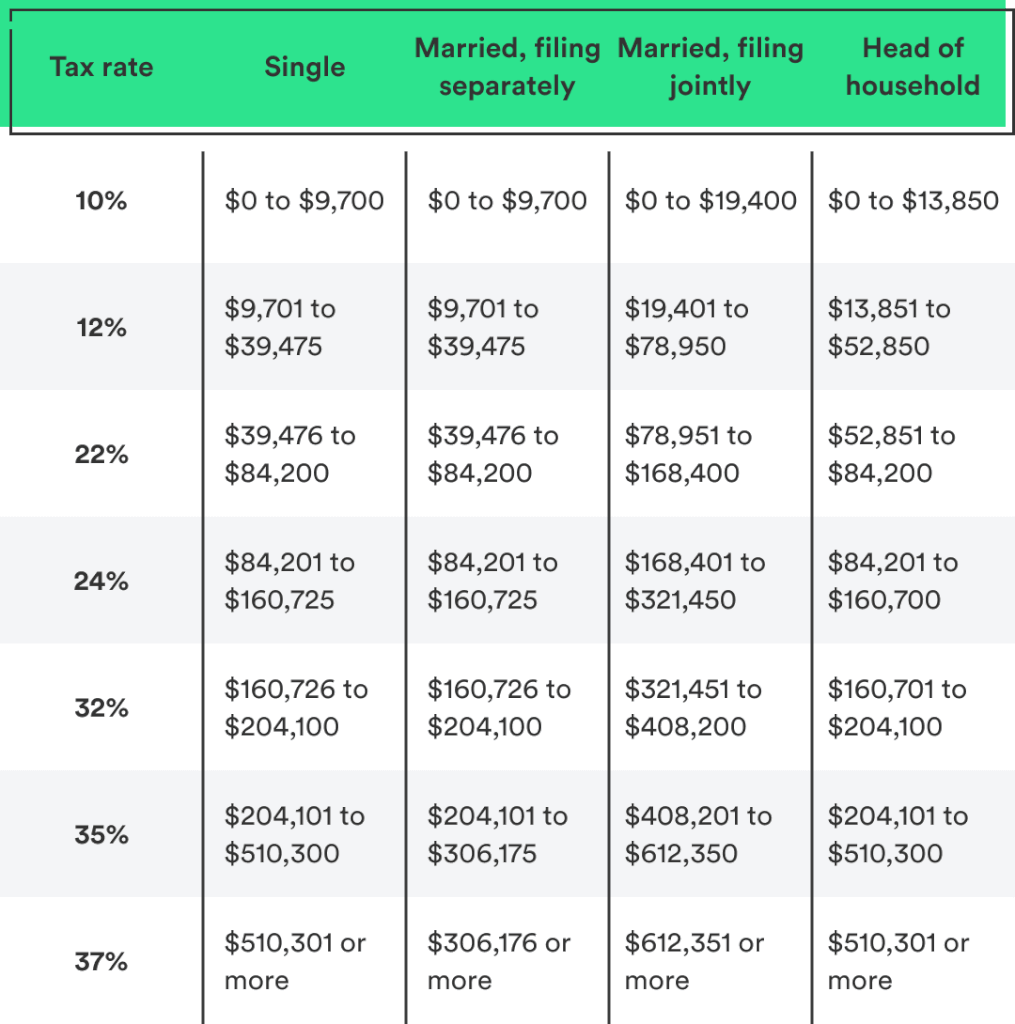

2024 Joint Filing Tax Brackets. Here's how those break out by filing status:. A taxpayer's bracket is based on his or her.

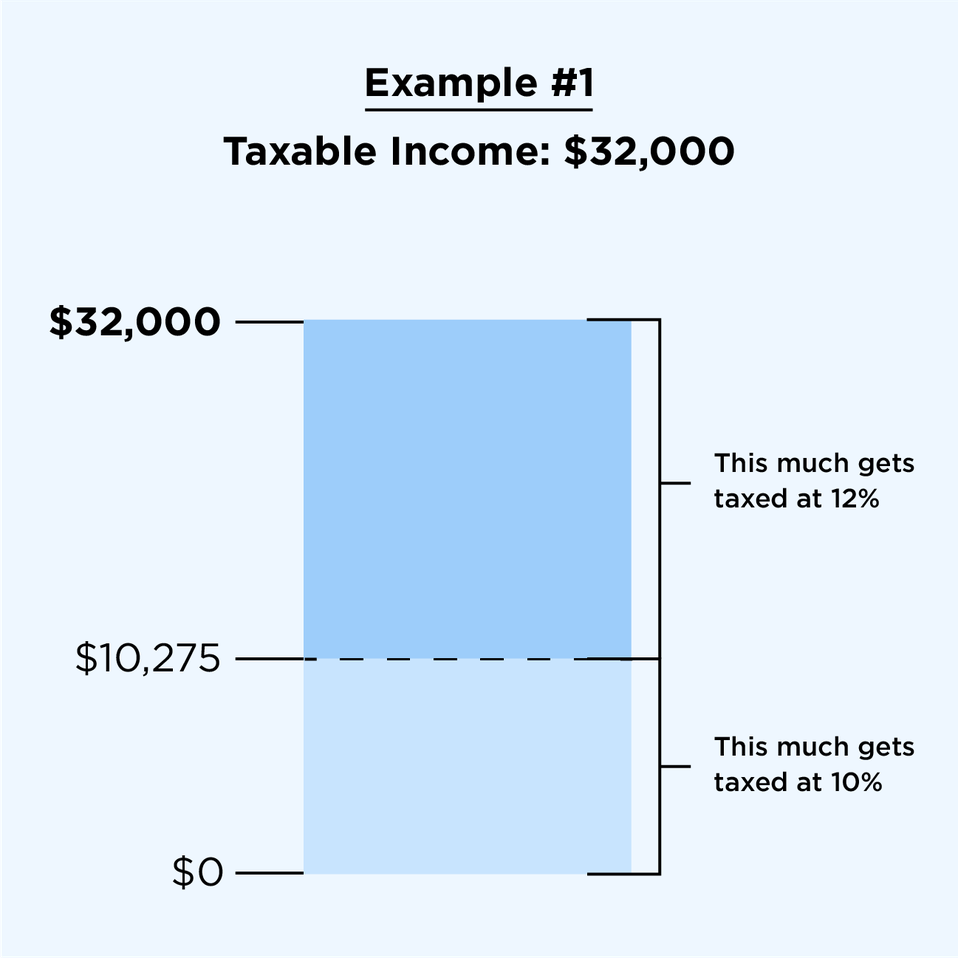

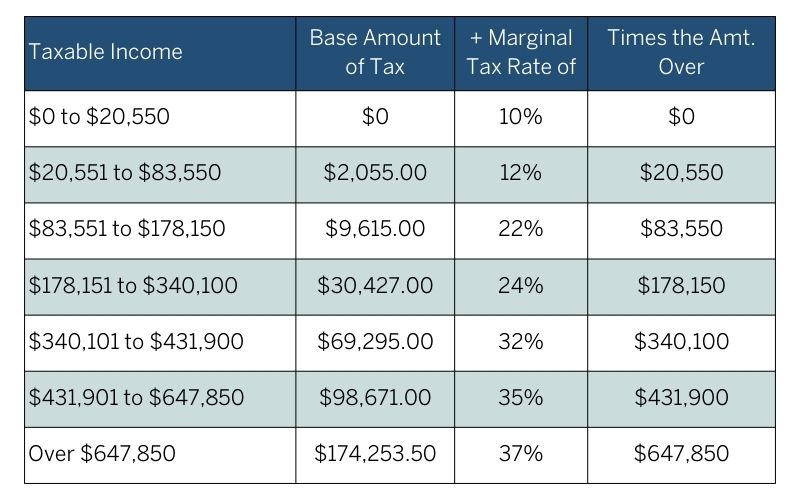

Understanding how your income falls into different tax brackets can help with tax. As your income goes up, the tax rate on the next layer of income is higher.

Up To $23,200 (Was $22,000 For 2023) — 10%;.

What are the tax brackets for 2024?

Choose Tax Regime Wisely For Tds, Consider Basic Exemption Limits, Utilize Tax Rebates, Deductions, And Exemptions.

Here are the 2024 income tax brackets for federal taxes due in april 2025:

$21,900 For Heads Of Households.

Images References :

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

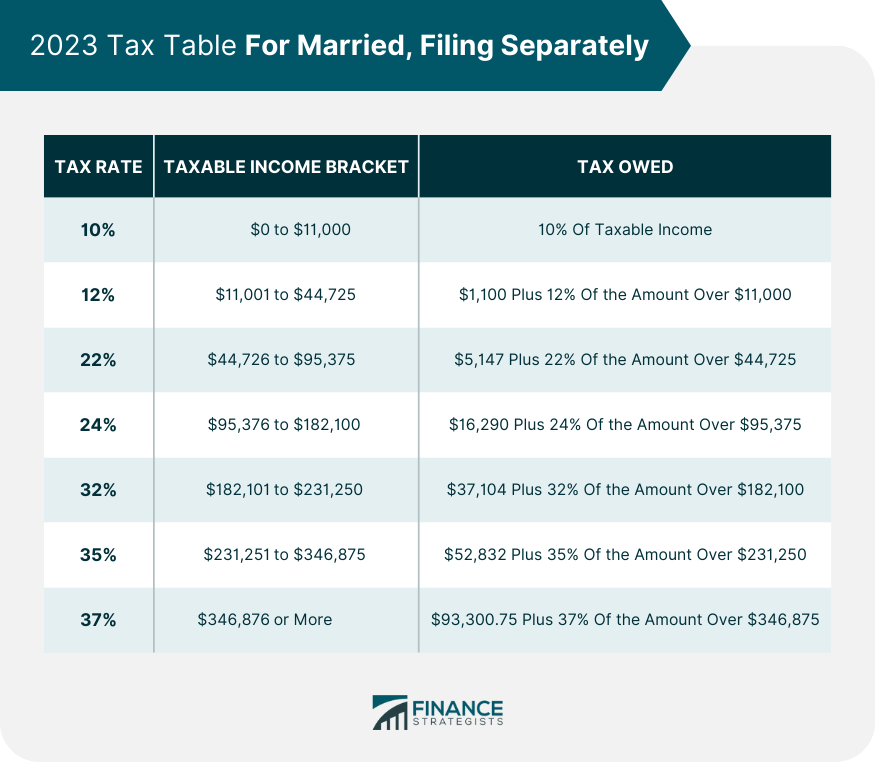

What Are The 2024 Tax Brackets For Married Filing Jointly Issi Charisse, 10%, 12%, 22%, 24%, 32%, 35% and 37%. If you look at the tax brackets for tax year 2023, you'll see that couples filing jointly get taxed 10% on the first $22,000 of their taxable income —.

Source: bobbyeqestrella.pages.dev

Source: bobbyeqestrella.pages.dev

What Are The 2024 Tax Brackets For Married Filing Jointly Issi Charisse, It’s worth noting that the top tax rate remains 37%. 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).

Source: neswblogs.com

Source: neswblogs.com

Tax Filing 2022 Usa Latest News Update, Choose tax regime wisely for tds, consider basic exemption limits, utilize tax rebates, deductions, and exemptions. The highest individual tax bracket is 37%.

Source: marniawlina.pages.dev

Source: marniawlina.pages.dev

Tax Brackets 2024 Married Jointly Calculator Kira Randee, Here are the updated tax brackets for 2024, as per the irs’ official announcement this past november. There are seven (7) tax rates in 2024.

Source: www.nerdwallet.com

Source: www.nerdwallet.com

20232024 Tax Brackets and Federal Tax Rates NerdWallet, What are the tax brackets for 2024? As your income goes up, the tax rate on the next layer of income is higher.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, The irs set federal income tax brackets for 2024, with earnings thresholds for each tier moving up by about 5.4% for inflation. For 2024, the lowest rate of 10% will apply to individuals with taxable income up to $11,600.

Source: www.bluechippartners.com

Source: www.bluechippartners.com

What Is My Tax Bracket 2022 Blue Chip Partners, Understanding how your income falls into different tax brackets can help with tax. Find out how much you’ll pay in federal income taxes.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, These brackets apply to federal income tax returns you would normally file in early 2025.) it's also. Estimate your 2023 taxable income (for taxes filed in 2024) with our tax bracket calculator.

Source: www.investors.com

Source: www.investors.com

How Trump Changed Tax Brackets And Rates Stock News & Stock Market, 2024 federal income tax brackets and rates. There are seven (7) tax rates in 2024.

Source: www.financestrategists.com

Source: www.financestrategists.com

Tax Brackets Definition, Types, How They Work, 2023 Rates, 37% for individual single taxpayers with incomes greater than $609,350 and for married couples. You pay tax as a percentage of your income in layers called tax brackets.

The Highest Individual Tax Bracket Is 37%.

For 2024, the lowest rate of 10% will apply to individuals with taxable income up to $11,600.

Choose Tax Regime Wisely For Tds, Consider Basic Exemption Limits, Utilize Tax Rebates, Deductions, And Exemptions.

10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate ).